The reporting framework is considered as an independent device that is planned to provide the assistance to companies to prepare their ESG disclosures and sustainability reports. It makes the organizations enable to disclose the financial reporting results and to measure their sustainability performance.

Difference between Frameworks and Standards

Frameworks are responsible to provide set of principles and guidelines of how a report is structured whereas standards provide detailed and specific requirements that what should be mentioned for each topic in the report along with the matrices. The Standards make frameworks actionable, by ensuring the consistent disclosure. [1]

ESG Reporting Frameworks

ESG reporting frameworks is based on the sets of largest factors that measure the impact of company performance throughout the world. It has been fast becoming the standard for the companies to accomplish their tasks and report their risks.

Top 5 ESG Reporting Frameworks

Nowadays, there exists a number of ESG reporting frameworks and all of them have its own methodology, scoring system and metrics. But, the topmost 5 ESG reporting frameworks, which are used worldwide, are:

1. CDP

2. CDSB

3. GRI

4. IIRC

5. SASB

1. Carbon Disclosure Project (CDP)

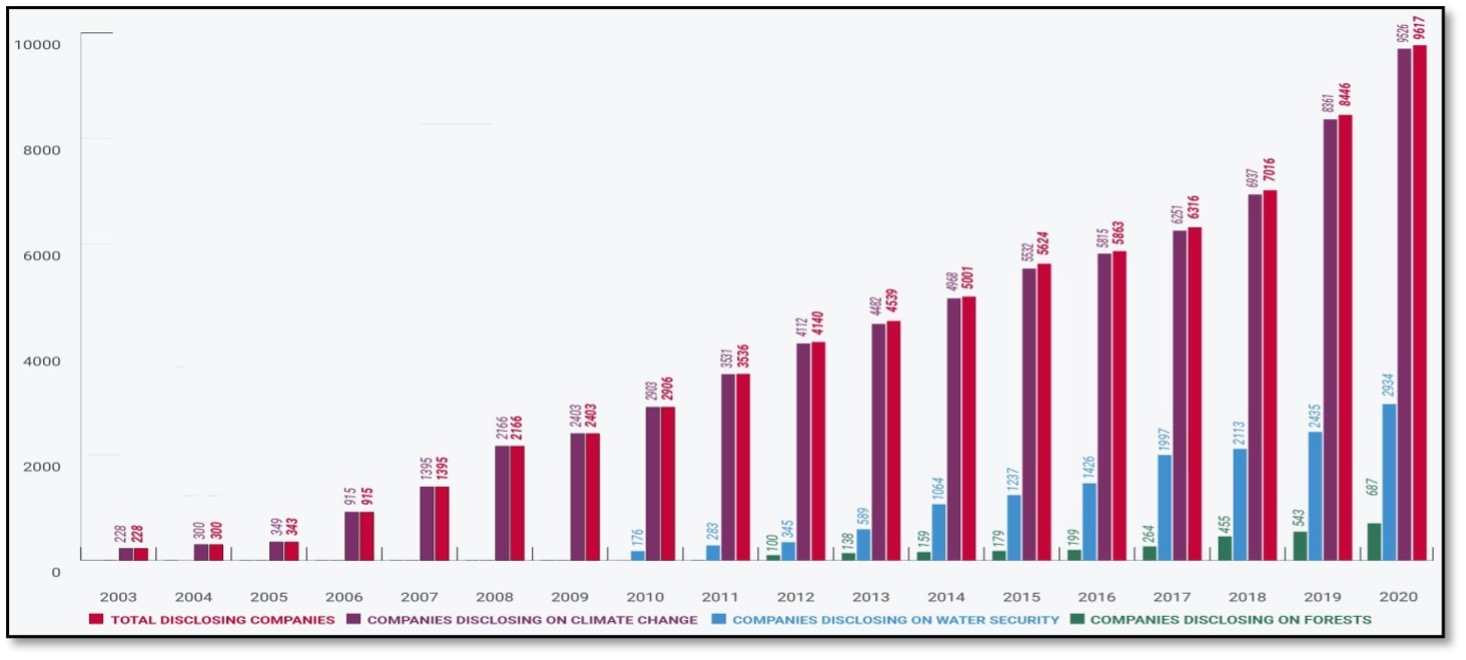

CDP or Carbon Disclosure Project was established in 2000. The notion was very modest to associate the fiduciary duty with environmental integrity. Currently, over 9.600 corporations including 800 states, regions and cities, internationally expose their environmental impacts by using CDP, creating it one of the most extensively used reporting frameworks.

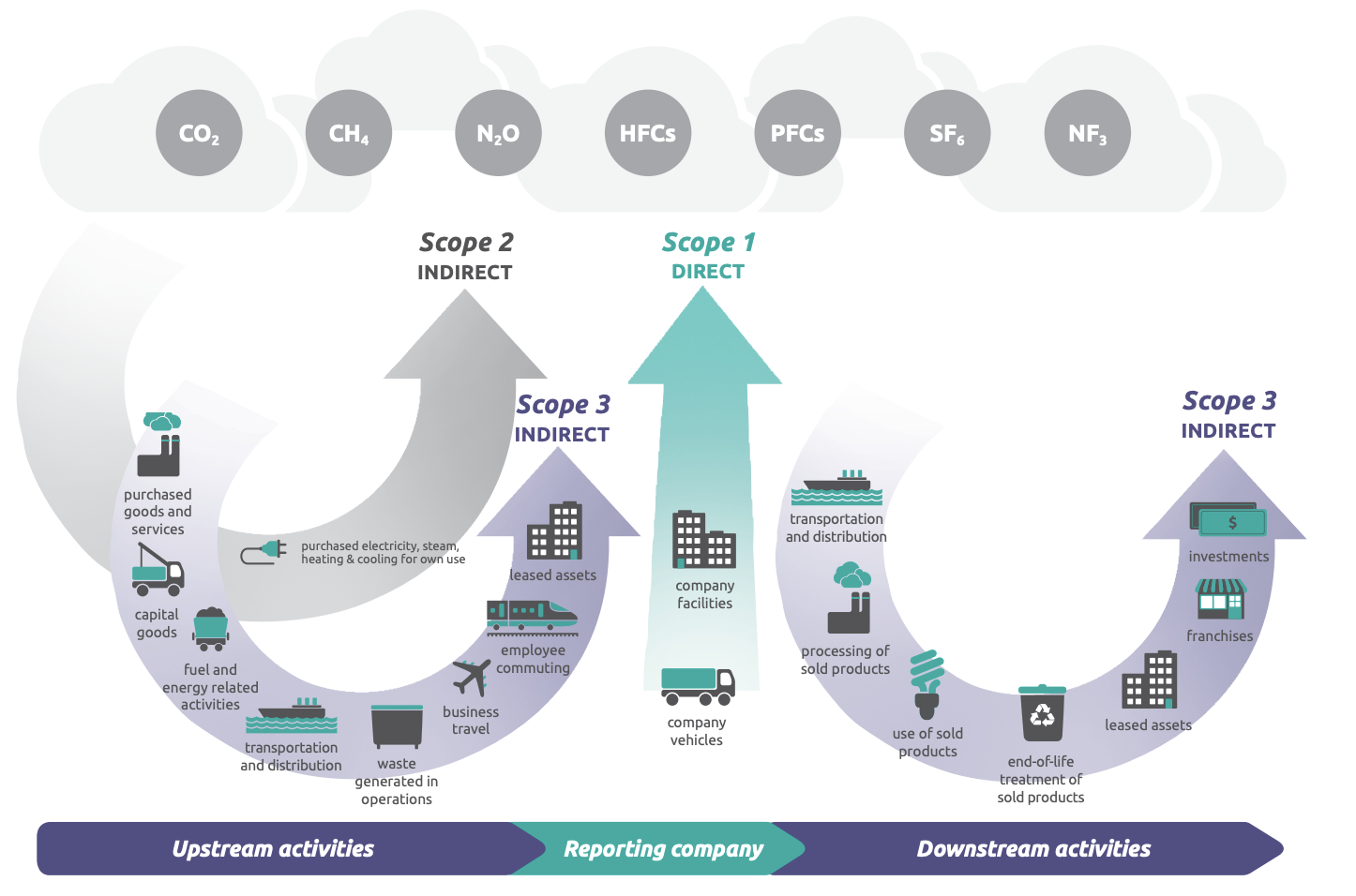

The companies which report to CDP utilize the GHG protocol to provide the ESG data on sustainability. Even all other reporting standards are using the GHG protocol for the first pillar, environmental. GHG protocol provides a comprehensive global standardized framework to determine and handle greenhouse gas (GHG) emissions from public and private sectors operations, mitigation actions and value chains.

Respectively each year, CDP gathers the data delivered by the companies for the yearly reporting and provides the scores to the companies centered on their actions and environmental clearness. Both the scores and the CDP data are utilized by financiers to notify their results. The corporations which mark high on CDP level achieve a competitive improvement above their peers. These scores can also be utilized within the organization as an instrument to scale the progress and confirm that their approaches are affiliated with existing best practices. The name CDP indicates that its emphases principally on climate impacts for instance water usage, deforestation and carbon emissions. [2]

Figure 2: Disclosing by category

2. Climate Disclosure Standards Board (CDSB)

The CDSB was created in 2007 by the World Economic Forum (WEF) in their annual meeting, but the framework of CDSB was presented in 2015. The framework of Climate Disclosure Standards Board (CDSB) focuses on broadcasting the environmental information. But, the framework of CDSB varies in some ways.

The framework of CDP offers the structure to collect data for reporting, whereas, CDSB framework intends to incorporate climate change-related discovery into conventional economic reports for instance 10-K filing and annual reports. In this way, CDSB expects to encourage the influences of corporate policy and sustainability.

The framework of CDSB does not provide its peculiar metrics to report the data. Somewhat, it is entirely dependent on metrics settled by former standards system of government like CDP, WRI, GRI, SASB, and WBCSD.

The latest form of CDSB Framework is entirely in alignment with the commendations of the G20 Task Force on Climate-related Financial Disclosures (TCFD) recommendations, producing it as a valuable means for the firms which want to impose the task force’s sanctions. This is a method of act in accordance with the regulations of environmental disclosure for example the European Union (EU) Non-Financial Reporting Directive.

TCFD means the Task Force on Climate-related Financial Disclosures. It was designed by the Financial Stability Board, which is an international body that pursues to support and safeguard the worldwide financial markets from universal risks for instance climate change. The guidelines of TCFD provide direction to all the participants of market on the revelation of information on the financial effects of climate-related risks to inculcate them in business practices.

Currently, the framework of CDSB has been extensively used by 374 companies including 32 countries and 10 sectors, comprising of Coca Cola and Nestle. [3]

3. Global Reporting Initiative (GRI)

The GRI was introduced in 1997 which was the first and foremost universal standard for reporting the sustainability. It was established by the United Nations Environment Program (UNEP) and Coalition for Environmentally Responsible Economies (CERES) in response to Exxon Valdez oil spill.

After thirty years, GRI remained has been the most broadly used ESG reporting framework. Over 13.000 organizations in the 90 countries hadbeen using GRI for the reporting of sustainability. But now more than 190 corporate out of 250 largest companies practice GRI. These companies include:

- ABB Group (Switzerland)

- Cigna (USA)

- Eni (Italy)

- Ferrero Group (Luxembourg)

- Fujitsu (Japan)

- Grupo Bimbo (Mexico)

- IHS Towers (Nigeria)

- Inditex (Spain)

- Salesforce (USA)

- City Developments Limited (Singapore)

These company members are present in Africa, Asia, North America, Latin America and Europe. And these companies range from healthcare, spanning energy and textile to telecom.

Though, the GRI framework is not only useful for the smaller companies but also for larger international enterprises.

The flexibility of GRI makes it more useful. Moreover, the standards of GRI are always developing. Such as, currently GRI is reviewing its criterions to develop human rights reporting. [4]

4. International Integrated Reporting Council (IIRC)

The IIRC’s International Integrated Reporting Framework (IRF) was first released in 2013 and it was a milestone improvement in market-led business reporting.

It’s vision was to alter the conventional reporting ways and to introduce the modern reporting structure. Many detached corporate report companies created and replaced their former reporting system with the modern integrated approach which explained to the providers about the financial capital that how a company creates, and maintains values over the time. The framework of IRF made the information of sustainability accessible to insurers, lenders and investors, in a brief layout.

The framework of IIRC’s is consisted on environmental, social, and governance (ESG) aspects. IRF states the crucial content to include in reports, comprising on business models, governance, outlook, performance, risks and opportunities, basis of preparation and presentation, strategy and resource allocation.

Latest updates to the frameworks of IIRC in 2021 promoted in restructuring the process of reporting for preparers. The updates also focused on providing improved quality understandings for handlers of material. IIRC assessments elaborated that 1.600 companies in 64 countries are working on the way to integrated reporting. [5]

5. Sustainability Accounting Standards Board (SASB)

In the late 2010, another development of SASB standards was introduced. It was a set of 77 industry standards which companies can utilize to recognize and report the financial sustainability to their investors.

The unique quality of SASB is that it lays out the particular topics of sustainability and its related metrics for all industries for instance oil and gas, utilities and transportation. It is specifically very beneficial for those organisations that need help to determine the disclosure theme to report their financial data and metrics for reporting. More than 120 companies are presently using the SASB standards, including JetBlue, Nike, and General Motors. [6]

How companies should choose the relevant reporting standard / framework for effective ESG Reporting:

The reporting on ESG from the companies all over the world has increased to 90% in 2019 from 20% in 2011.

When companies have to choose an effective framework for reporting ESG data, it is necessary to analyze that which sector they are going to deal such as climate change, human capital or social capital and who is their target audience. As the data provided by the companies will reflect its image and therefore, the provided ESG information of corporate should be relevant to stakeholders.

The focus of financial community (investors, stakeholders and creditors) has been shifted to ESG performance data of companies to better understand the risks and opportunities of specific corporate so that they can make a decision on the critical matter of their investment. [7]

| No | Framework | Audience and scope | Region |

| 1 | SASB (uses GHG protocol) | For investorsSector-specific guidance | More than 120 companies are presently using the SASB standards, including JetBlue, Nike, and General Motors. |

| 2 | IIRC (uses GHG protocol) | For investorsNon-sector specific guidance | 1600 corporate in 64 companies |

| 3 | TSFD (aligned with CDSB) | For investorsSome specific guidance | 374 companies including 32 countries and 10 sectors, comprising of Coca Cola and Nestle. |

| 4 | CDP/CDSB (uses GHG protocol) | For stakeholders Sector-specific guidance | Over 9,600 corporations including 800 states, regions and cities, internationally expose their environmental impacts by using CDP |

| 5 | GRI (uses GHG protocol) | For stakeholders Some sector-specific guidance | Most widely used in the world |

What has Analytics to do with an effective ESG Reporting:

You can use analytics for a wide range of use cases and ESG is only one of them. This part will not go into details why you should use analytics, this should already be part of your daily business. Making data driven decisions should be as normal as checking the reviews for a restaurant on Google Maps or a product on Amazon.

Let’s assume you you know how to use analytics or at least someone in your organisation. What are the challenges to do ESG reporting? Your tools should be flexible enough to adjust to your individual needs. If you want to use GRI or SASB, the tools should be customisable. What I currently see on the market are a lot of new startups, which are helping to become more sustainable, but they are static and immature from a technical standpoint. I see more innovations in the space of methods and process innovation to tackle the climate change problem and more. But, if we ignore that it is about ESG reporting, there are already solutions out there which can be used to achieve the same and even more.

Another challenge is definitely to collect the data from all necessary sources. Collecting information from your suppliers in a standardised form to understand which impact they have on your products. Or what about each individual employee. Do they commute by car, train or even airplane. Sure, an airplane is probably used by the management like in case of Elon Musik. He uses an airplane to commute between Los Angeles (SpaceX) and San Francisco (Tesla), but on the other hand he is changing the automotive industry to become hopefully more sustainable.

Analytics should be flexible and not dictate you on the path to become a carbon neutral organisation. And, we will need a better way to connect all the different datasources which can help us to understand what has a big impact on the ESG score and ultimately on the climate change.

Conclusion

Although, there are many differences among the ESG reporting frameworks yet there are various overlaps. It has created confusion for users and preparers of ESG reports.

Several corporates and stakeholders have argued that a simplified ESG reporting framework must be present for modest understanding. A distinct and universal framework will make it at ease for the companies to recognize and report on ESG performance. Also the investors will find it easy to compare the sustainability score of different companies.

As the significance of ESG reporting frameworks has been increasing day by day, these current five leading sustainability corporates have taken step to introduce a more unified and comprehensive corporate reporting system. Only the time will expose that how far it will move but ESG disclosure is for sure to stay.

To help organisations on the way to become carbon neutral, a flexible technology stack is necessary to match the requirements and to be able to collect the necessary data.

Reference:

[1] https://www.sasb.org/about/sasb-and-other-esg-frameworks/

[2] http://www.perillon.com/blog/esg-reporting-frameworks

[3] https://www.globalreporting.org/standards/;

https://www.globalreporting.org/about-gri/news-center/companies-commit-to-sdgs-collaboration/

[4] https://www.integratedreporting.org/wp-content/uploads/2021/01/InternationalIntegratedReportingFramework.pdf

[5] http://www.perillon.com/blog/esg-reporting-frameworks

[6] https://www.sasb.org/standards/materiality-map/

[7] https://www.scottmadden.com/insight/decoding-sustainability-reporting-frameworks/;

https://www.globenewswire.com/news-release/2020/07/16/2063434/0/en/90-of-S-P-500-Index-Companies-Publish-Sustainability-Reports-in-2019-G-A-Announces-in-its-Latest-Annual-2020-Flash-Report.html;

https://www.ga-institute.com/storage/press-releases/article/flash-report-86-of-sp-500-indexR-companies-publish-sustainability-responsibility-reports-in-20.html#:~:text=%E2%80%9CSustainability%20reporting%E2%80%9D%20rose%20dramatically%20from,of%20companies%20reporting%20in%202018.;

https://www.barrons.com/articles/changes-are-coming-to-financial-regulation-what-it-means-for-investors-51612441800